Nys Income Tax Brackets 2024. The seven irs tax brackets determine how much you will owe in taxes on your income. In parts of the state, like new york city, all types of taxes are even higher.

New york’s 2024 income tax ranges from 4% to 10.9%. Married filing jointly, surviving spouse:

Calculate Your New York State Income Taxes.

Head of household income range:.

To Estimate Your Tax Return For 2024/25, Please Select.

The irs has already released tax brackets for 2024, the taxes you will file in 2025.

Tax Brackets And Rates Depend On Taxable Income, Adjusted Gross Income And Filing Status.

Images References :

Here are the federal tax brackets for 2023 vs. 2022 Narrative News, 4%, 4.5%, 5.25%, 5.5%, 6%, 6.85%, 9.65%, 10.3%, and 10.9%. The new york paycheck calculator covers a wide range of topics, including effective tax rates, tax brackets, state taxes, deductions, and even tax credits, so keep.

Source: 2023bgh.blogspot.com

Source: 2023bgh.blogspot.com

10+ 2023 California Tax Brackets References 2023 BGH, Calculate your new york state income taxes. New york residents state income tax tables for single filers in 2024 personal income tax rates and thresholds (annual) tax rate taxable income threshold;

Source: topdollarinvestor.com

Source: topdollarinvestor.com

2023 Tax Rates & Federal Tax Brackets Top Dollar, Residency status also determines what’s. New york state offers a range of income tax rates, including 4%, 4.5%, 5.25%, 5.5%, 6%, 6.85%, 9.65%, 10.3%, and 10.9%.

Source: patiencewliz.pages.dev

Source: patiencewliz.pages.dev

20242024 Tax Calculator Teena Genvieve, The annual salary calculator is updated with the latest income tax rates in new york for 2024 and is a great calculator for working out your income tax and salary after tax based. The calculator is updated with the latest tax rates and brackets as per the 2024 tax year in new york.

Source: federalwithholdingtables.net

Source: federalwithholdingtables.net

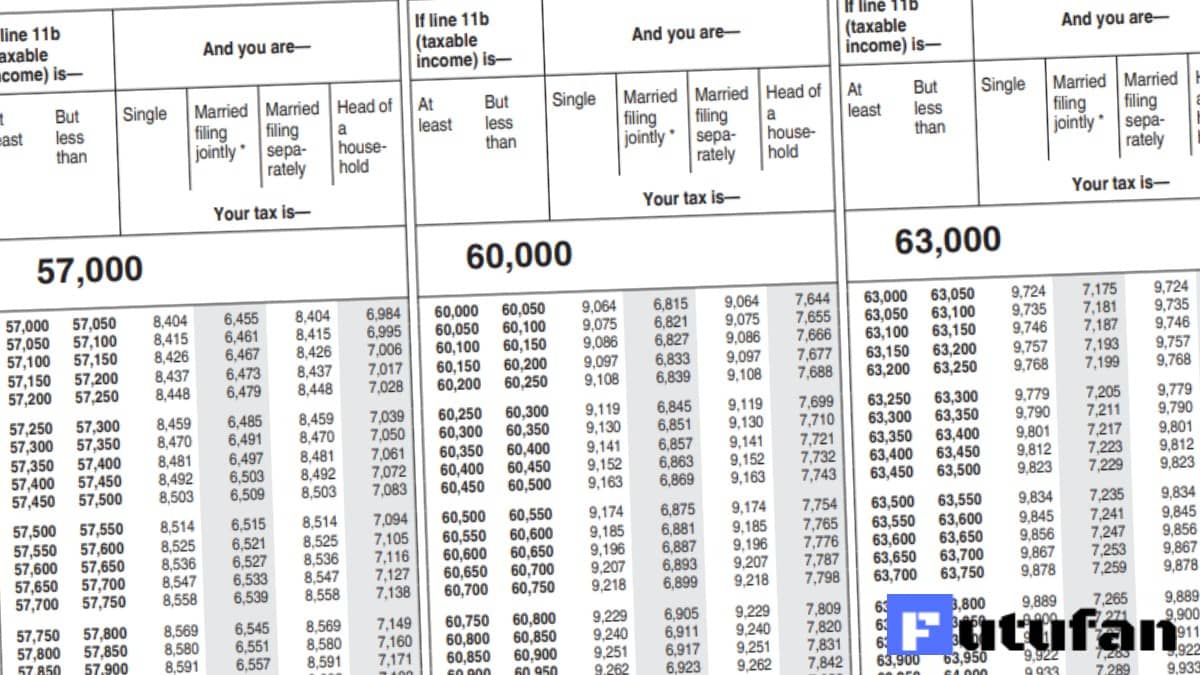

IRS Tax Tables 2021 Tax Tables Federal Federal Withholding Tables 2021, Income from $ 11,600.01 : Tax brackets and rates depend on taxable income, adjusted gross income and filing status.

Source: incomrae.blogspot.com

Source: incomrae.blogspot.com

What Are Tax Brackets, 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. New york state income tax rates range from 4% to 10.9%.

Source: www.linkedin.com

Source: www.linkedin.com

Understanding 2023 Tax Brackets What You Need To Know, New york's 2024 income tax ranges from 4% to 10.9%. The new york state tax calculator (nys tax calculator) uses the latest federal tax tables and state tax tables for 2024/25.

Source: www.nbcnewyork.com

Source: www.nbcnewyork.com

Here Are Your New Tax Brackets for 2020 NBC New York, In parts of the state, like new york city, all types of taxes are even higher. Income from $ 11,600.01 :

Source: neswblogs.com

Source: neswblogs.com

Tax Filing 2022 Usa Latest News Update, Head of household income range:. Overview of new york taxes.

Source: thehill.com

Source: thehill.com

Tax filers can keep more money in 2023 as IRS shifts brackets The Hill, Updated on feb 16 2024. New york state income tax rates range from 4% to 10.9%.

Enter Your Financial Details To Calculate Your Taxes.

4%, 4.5%, 5.25%, 5.5%, 6%, 6.85%, 9.65%, 10.3%, and 10.9%.

The Calculator Is Updated With The Latest Tax Rates And Brackets As Per The 2024 Tax Year In New York.

There are currently nine tax brackets in new york state, with rates ranging from 4% to 10.9% for the 2022 tax year, that vary based on filing status.