Maine Taxes 2024. Maine revenue services released the individual income tax rate schedules and personal exemption and standard. Income tax return after the april 15, 2024 maine tax extension.

The maine state tax calculator (mes tax calculator) uses the latest federal tax tables and state tax tables for 2024/25. See the rollout schedule below:

Payment Vouchers For The 2024 Tax Year.

For more information, refer to the determining residency status and/or the residency safe harbors for residents spending time outside maine guidance.

The Maine Tax Portal Is Being Rolled Out In Phases And Will Be Open For All Maine Taxpayers By The End Of 2024.

Washington — the internal revenue service announced today tax relief for individuals and businesses in parts of maine affected by severe storms and flooding.

Maine’s Tax System Ranks 35Th Overall On Our 2023 State Business Tax Climate Index.

Images References :

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, Use our income tax calculator to estimate how much tax you might pay on your taxable income. Income tax tables and other tax information is sourced from the maine.

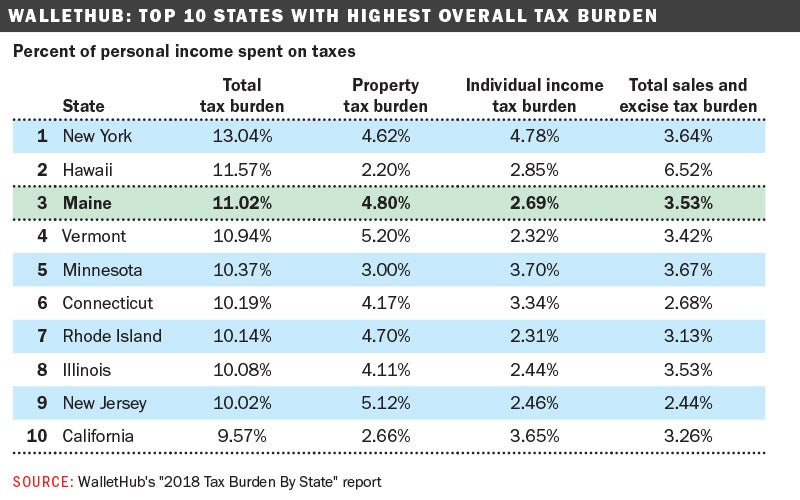

Source: www.mainebiz.biz

Source: www.mainebiz.biz

Maine makes top 5 in states with highest tax burden, Welcome to maine electronic filing. Payment vouchers for the 2024 tax year.

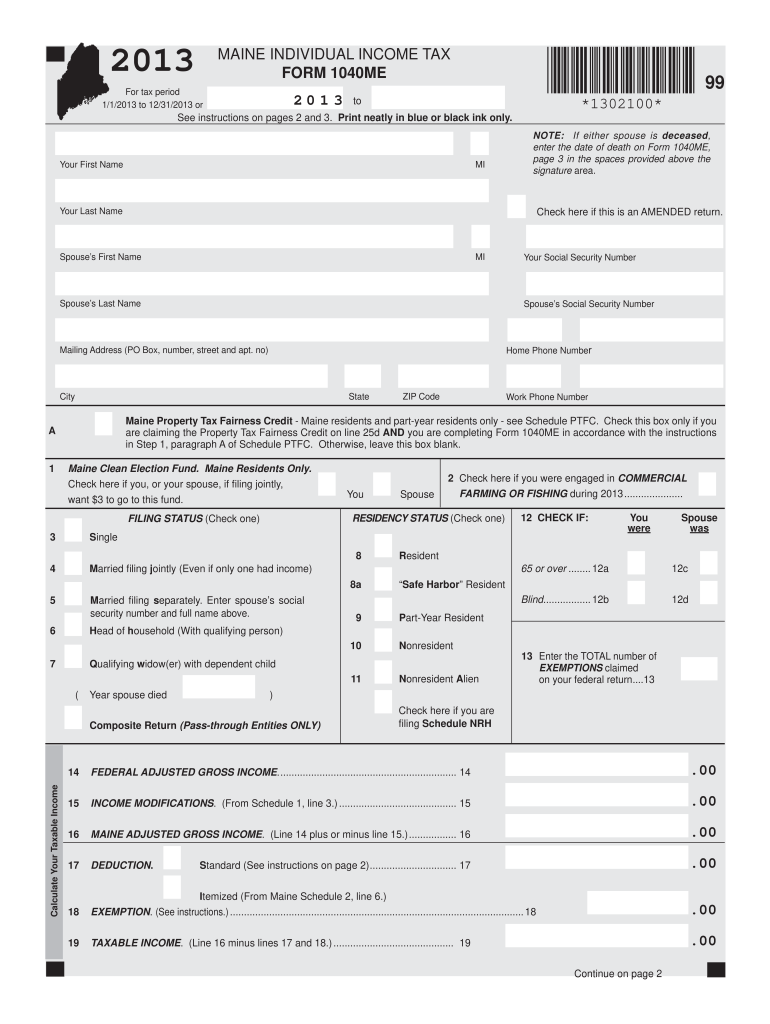

Source: www.signnow.com

Source: www.signnow.com

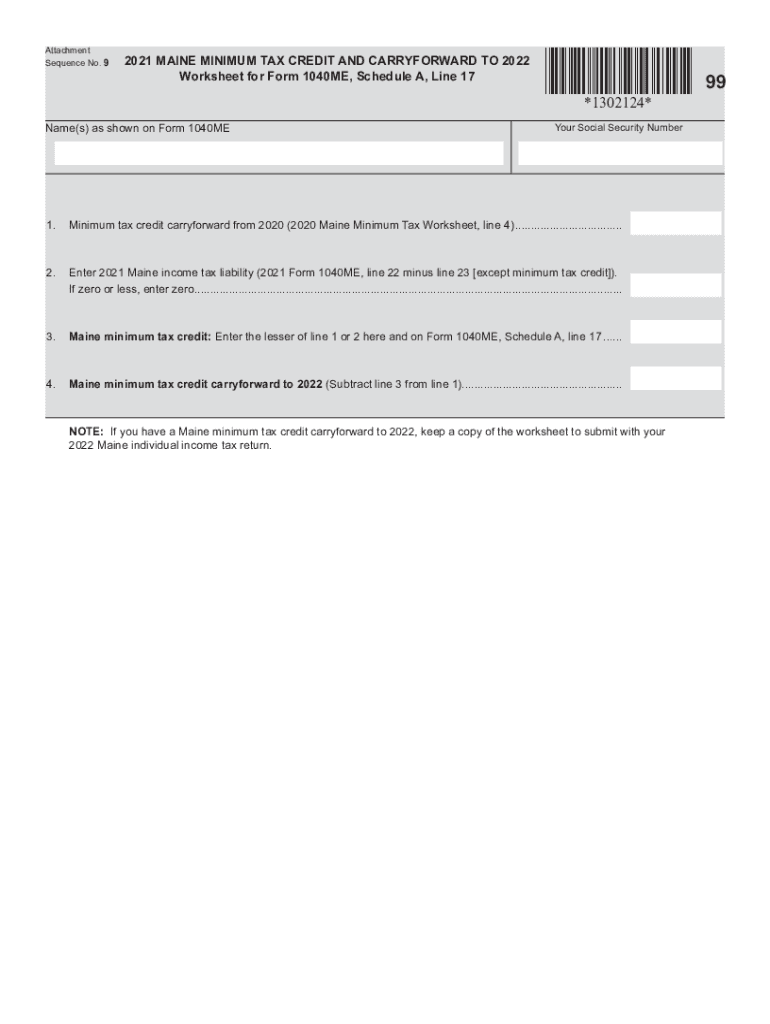

MAINE INDIVIDUAL TAX FORM 1040ME *1302100× 00 Fill Out and, In sum, taxes are due in the following maine counties as indicated: Maine has a 5.50 percent state sales tax rate and does not levy any local sales taxes.

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, Maine has a 5.50 percent state sales tax rate and does not levy any local sales taxes. Home > state tax > maine.

Source: taxfoundation.org

Source: taxfoundation.org

2023 State Tax Rates and Brackets Tax Foundation, The state income tax in maine is based on just three brackets. Welcome to maine electronic filing.

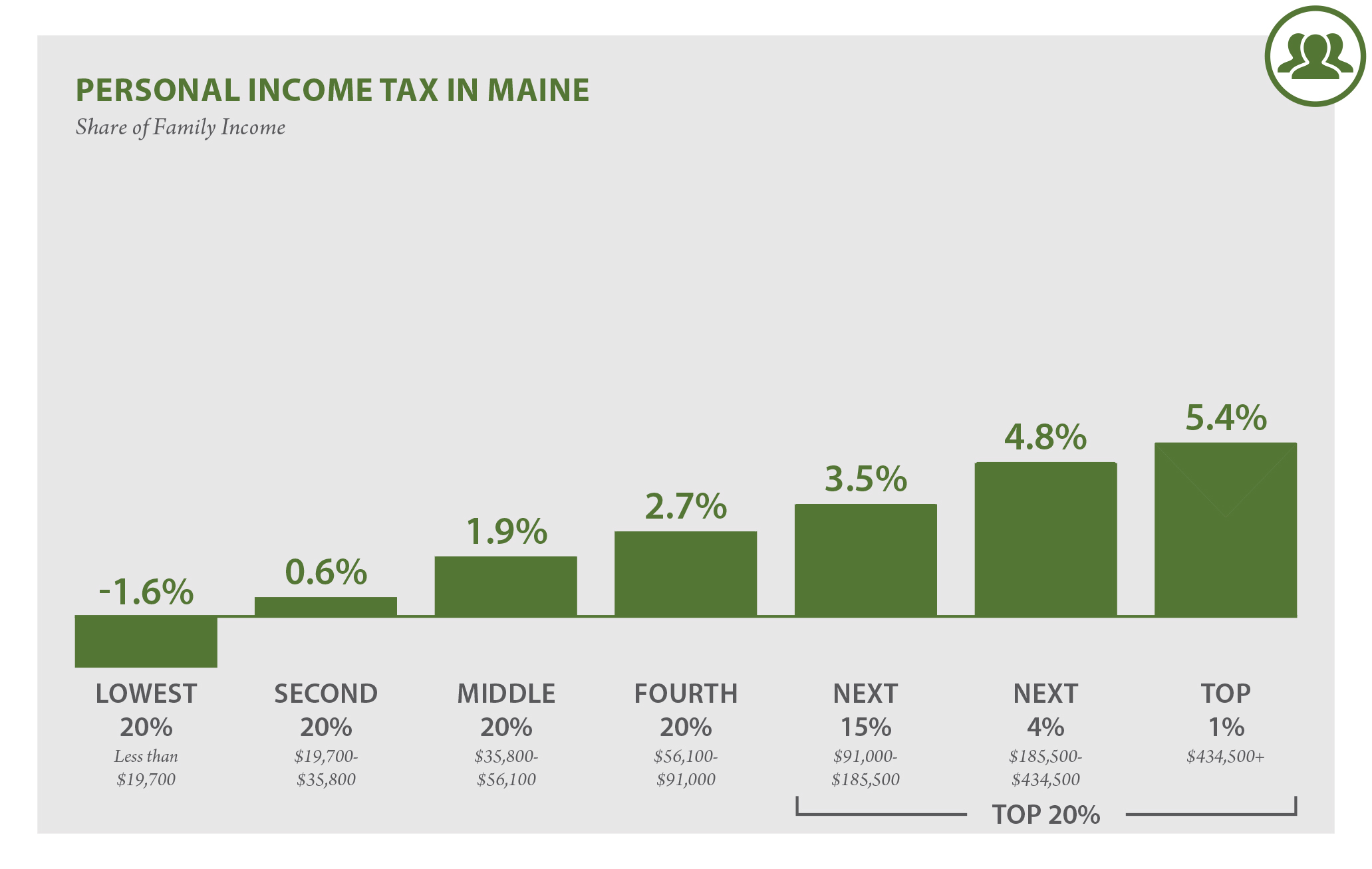

Source: itep.org

Source: itep.org

Maine Who Pays? 6th Edition ITEP, See the rollout schedule below: Below, we explain various state taxes affecting retirement income and your ability to live affordably in maine, such as sales tax, retirement tax, and property taxes.

Source: www.mainebiz.biz

Source: www.mainebiz.biz

Maine's tax burden is one of the highest, new study says, This page has the latest maine brackets and tax rates, plus a maine income tax calculator. Current year (2023) forms and tax rate schedules these are forms and tax rate schedules due in 2024 for income earned in 2023.

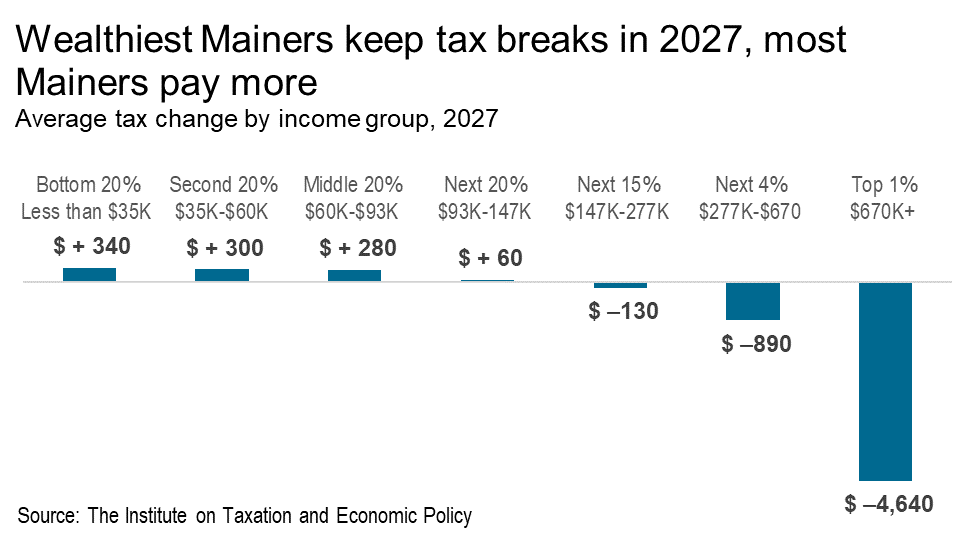

Source: www.mecep.org

Source: www.mecep.org

Maine families pay more under final GOP tax bill MECEP, Cumberland, hancock, knox, lincoln, sagadahoc,. Affected taxpayers now have extended tax deadlines of june 17, 2024, to file.

Source: www.signnow.com

Source: www.signnow.com

Maine Minimum Tax 20212024 Form Fill Out and Sign Printable PDF, Income tax return after the april 15, 2024 maine tax extension. Maine tax portal file upload specifications & instructions;

Source: www.maine.gov

Source: www.maine.gov

Maine Revenue Services, Affected taxpayers now have extended tax deadlines of june 17, 2024, to file. Current year (2023) forms and tax rate schedules these are forms and tax rate schedules due in 2024 for income earned in 2023.

Following President Biden’s Declaration, The Irs Announced Maine Taxpayers Affected By The Severe Storms Now Have Until June 17, 2024, To File.

Maine’s tax system ranks 35th overall on our 2023 state business tax climate index.

Affected Taxpayers Now Have Extended Tax Deadlines Of June 17, 2024, To File.

Washington — the internal revenue service announced today tax relief for individuals and businesses in parts of maine affected by severe storms and flooding.